Analysis of the GoM Report on GST for Online Gaming

A. Gaming Industry in India

“The gaming market is huge internationally and the number of youth connected to this market globally is increasing. That is why in this year’s [2022] budget we have focused on Animation Visual Effects Gaming Comic (AVGC)”1

Mr. Narendra Modi, Hon’ble Prime Minister of India

“The animation, visual effects, gaming, and comic (AVGC) sector offers immense potential to employ youth. An AVGC promotion task force with all stakeholders will be set-up to recommend ways to realize this and build domestic capacity for serving our markets and the global demand.”2

Ms. Nirmala Sitaraman, Hon’ble Finance Minister of India

A.1 At various instances, as illustrated above, the Hon’ble Prime Minister and Finance Minister of India have acknowledged the vast opportunity that the online gaming industry provides and applauded the contributions of Indian innovators and application developers in the sector.

A.2. The Indian gaming market is expected to grow from $2.8 billion in 2022 to $5 billion in 2025, growing at a CAGR of 28-30%, and the number of people playing such games is expected to expand from 420 million in 2022 to 450 million by 2023, and reach 500 million by 2025.3

A.3. The Frontier Technology Vertical at the Niti Aayog has also recognised the tremendous potential the industry holds to attract foreign investment, increase innovation, and generate employment in India. Indian gaming industry raised USD 2.8 Bn from domestic/global investors in the last 5 years.4 Funding increased by 380% from 2019 and 23% from 2020.5 These lucrative investments have propelled three Indian start-ups – Game 24X7, Dream11 and Mobile Premier League – to the status of gaming unicorns.6

A.4. Given the growth opportunities it promises, the sunrise sector deserves the support of the Government in terms of regulation, investment, and creation of an encouraging ecosystem. However, the report of the Group of Ministers (GoM) presented at the 47th GST Council Meeting recommending the taxing of online gaming platforms under GST fails to appreciate the nuances of the industry and the promise it holds to contribute to the nation’s economy. In the following sections, we analyse the GoM recommendations based on jurisprudence and recent regulatory developments.

(Source: investindia.gov.in)

B. Analysis of GoM Recommendations

Recommendation 1

Uniform treatment of online gaming with casinos, race courses and lottery

The GoM report recommended that “Imposition of GST on these activities namely, casinos, race courses, online gaming and lottery should be uniform (in terms of rate and valuation).”

1.1 The logic behind imposing a higher rate of GST on the listed activities is provided in paragraph 8.1 of the report. The relevant extract is reproduced below –

“The general view was that all these activities, because of their nature and negative externalities, should be levied a higher incidence of tax. The society at large is the biggest stakeholder in them. It was the unanimous decision of the GoM that the activities of casinos, race courses, and online gaming should be subjected to GST at the highest rate of 28%. It was also noted that there should be uniformity in rate of taxation on all actionable claims in any activity involving prize payouts/ betting in anticipation of winning. In other words, online gaming, casino, horse racing and lottery etc. are to be similarly taxed.” (emphasis supplied)

Online gaming not akin to gambling, betting or lottery – Six decades of jurisprudence

1.2 On online gaming being alike to gambling or betting, it is no more res integra that games of skill are neither gambling nor betting. The jurisprudence on games of skill versus games of chance has clearly established that games of skill cannot be held as betting and gambling. Therefore, in so far as online gaming is in the nature of a game of skill, it does not amount to gambling or betting. Consequently, to club all online gaming activities with lottery, gambling and betting is violative of the jurisprudence deliberated and upheld by the highest court of the country.

1.2.1 The Hon’ble Supreme Court in the case of RMD Chamarbaugwala (RMDC-1)7 held that any game/competition that relies substantially upon exercise of skill cannot be classified as ‘gambling’.

1.2.2 Further the Hon’ble Supreme Court in the case of RMDC-28 held that if competitions involve substantial skill, they do not amount to betting and gambling and the statute in question – the Prize Competition Act, 1955 was severed only to apply to competitions which do not depend substantially on skill i,e., games of chance. It is pertinent to note that though the definitions in the legislation were wide enough, the Apex Court still went on to interpret that games of skills are different from games of chances and applied the principle of severability to severe them for separate treatment.

1.2.3 The RMDC jurisprudence was employed in K. Satyanarayana9 where, basis the difference between “game of skill” and “game of chance”, the game of rummy was held to be a game of skill and therefore beyond the ambit of gambling.

1.2.4 Later in the case of M.J.Sivani10 it was acknowledged that “No game can be a game of skill alone. Even a skilled player in a game of mere skill may be lucky or unlucky so even in a game of mere skill chance must play its part.” This case laid down the preponderance test (also known as “the dominant factor test”) i.e., whether the game in question has a preponderance of skill over chance or vice versa, and the same is to be determined on the facts of every case.

1.2.5 The test was further elucidated in the case of K Lakshmanan11 where, relying on the cases of RMDC-1, RMDC-2 and K. Satyanarayana, the Hon’ble SC held that games where success depends on a substantial degree of skill are not “gambling” and that despite there being an element of chance, if a game is preponderantly a game of skill, it shall be a game of mere skill. It was held that the expression “mere skill” would mean substantial degree or preponderance of skill.

1.2.6 Further, the Madras High Court in the case of Junglee Games12 has held that the term ‘Betting’ in Entry 34 of the Second List of Schedule VII in the Constitution of India cannot be divorced from gambling and they must be read conjunctively. The relevant part of the judgement is extracted below –

“118. It is in such light that “Betting and gambling” in Entry 34 of the State List has to be seen, where betting cannot be divorced from gambling and treated as an additional field for the State to legislate on, apart from the betting involved in gambling. Since gambling is judicially defined, the betting that the State can legislate on has to be the betting pertaining to gambling; ergo, betting only on games of chance. At any rate, even otherwise, the judgments in the two Chamarbaugwala cases and in K.R. Lakshmanan also instruct that the concept of betting in the Entry cannot cover games of skill. ……. .

119. In the State bringing in the Ordinance in November, 2020, which was later adopted as the Amending Act, the legislature erred in expanding its field of legislation by widening the scope of gambling and ascribing a connotation to betting that the relevant Entry in the State List does not envisage. It is true that the Entry “Betting and gambling” appears, at first blush to cover the possible distinct fields of betting and gambling; but the law as declared defines gambling as a game of chance which skill cannot control; and. the authority conferred on a State legislature by the relevant Entry appears to be confined to the arena of betting in games of chance. Viewed in such perspective the impugned legislation does not appear to be genuinely referable to the field of legislation allotted to the State under Entry-34 of the State List.”

1.2.7 Similarly, the Karnataka High Court in the case of All India Gaming Federation13 has interpreted the scope of Entry 34 of the State List and defined the term ‘Betting’ as follows: “The two words namely “Betting” and “gambling” as employed in Entry 34, List II have to be read conjunctively to mean only betting on gambling activities that fall within the legislative competence of the State. To put it in a different way, the word “betting” employed in this Entry takes its colour from the companion word “gambling”.

1.2.8 More recently and pertinently, the Hon’ble High Court of Karnataka in the matter of Gameskraft Technologies Pvt Ltd14 has clearly held that games of skill are part of the set of actionable claims whose supply is deemed as neither supply of goods nor supply of services and therefore beyond the scope of GST Act.

1.2.9 Therefore, it is clear that “lottery”, “betting” or “gambling” would not include within its ambit a game of skill. Further, as clarified from the jurisprudence discussed supra, “betting” and “gambling” only cover situations where money is staked over uncertain events, the outcomes of which are matters of chance, and not such events whose outcome depend upon the skill of the player. Hence the clubbing of online gaming with lottery, betting and gambling without appreciating the nuance of games of chance versus games of skill is arbitrary, unsound and illegal.

1.3 Therefore, for all the reasons mentioned supra, the recommendation that casinos, race courses, online gaming and lottery be treated uniformly for GST purposes is misplaced and fails to consider six decades of jurisprudence on gaming versus gambling.

Recommendation 2

No distinction between games of skill and games of chance

The GoM recommended that “For the purpose of levy of GST, no distinction should be made in these activities merely on the ground that an activity is a game of skill or of chance or both.”

2.1 The relevant reasoning behind this recommendation is provided in para 8.2, the relevant extract of which is reproduced below –

“As regards the question whether the activities of horse racing, casinos and online gaming are activities of games of skill or chance, the general view was that this should not be relevant for GST regime. In all probability, these may have some elements of both. So long as there is betting for monetary winnings, the activities should be similarly taxed, including actionable claims forming part of these activities.” (emphasis supplied)

Games of skill are legally differentiated and constitutionally protected unlike games of chance

2.2 This line of reasoning that the question of games of skill vs. games of chance being irrelevant for taxation purpose is misplaced. Almost six decades of jurisprudence on the question of games of skill versus games of chance has clearly established that games of skill amount to trade and are protected under the Article 19(1)(g) of the Constitution of India whereas games of chance amount to gambling and not trade, consequently not protected under the said Article of the Constitution. As the Law Commission of the Government of India in its report clearly noted –

“The main test to determine whether a game amounts to gambling or not is, what dominates/ preponderates, whether skill or chance. Games of chance are those where the winner is predominantly determined by luck; the result of the game is entirely uncertain and a person is unable to influence such result by his mental or physical skill. The person indulging in game of chance wins or loses by sheer luck and skill has no role to play. On the other hand, the result of a game of skill is influenced by the expertise, knowledge and training of the player. In India, games of chance fall under the category of gambling, and are generally prohibited, while games of skill, falling outside the ambit of gambling are usually exempted.”15

2.3 As the Hon’ble High Court of Karnataka in its order in the matter of M/s Gameskraft Technologies Private Limited dated 11.05.2023 clearly held “the interpretation of games of skill is fundamental to understand whether [the activities] fit into the realm of actionable claim on one side or whether they would fit into the realm of the sub sect of actionable claim, that is, lottery, betting and gambling so that they could be subjected to tax in the latter category. If they are in the former category, they would not be eligible to tax by virtue of Schedule III [of the CGST Act, 2017].”16

2.4 The Hon’ble HC reviewed the jurisprudence on games of skill vs. games of chance and clearly explained that the expression “betting and gambling” under the GST Act is not a new addition, but it has been removed from the Seventh schedule of the Constitution to enable the taxing of these activities under GST unlike the erstwhile practice of State governments taxing these activities separately.

2.4.1 The erstwhile Entry 62 of List II of the Seventh schedule of the Constitution dealt with tax on “betting and gambling”. This entry was omitted By the Constitution (One Hundred and First Amendment) Act, 2016. The purpose of this omission was to subsume taxation on betting and gambling under GST.

2.4.2 Consequently, the High Court explained that the same expression “betting and gambling” now features in Entry 6 of Schedule III of the CGST Act.

2.4.3 As the expression “betting and gambling” was omitted from Entry 62 to give way for taxation 6 on “betting and gambling” to be subsumed under the GST regime, the Court held that the expression “betting and gambling” in Entry 6 of Schedule III of the CGST Act must also be interpreted in the same manner as it previously was.

2.4.4 Relying on the principle that “When words acquire a technical meaning because of their authoritative construction by superior courts, they must be understood in that sense when used in a similar context in subsequent legislations,” which has been upheld by the Apex Court in Diwan Brothers17, the High Court held that “betting and gambling” in Entry 6 of Schedule III of the CGST Act must be given the same interpretation given to them by the courts, in the context of the erstwhile entry of the Seventh Schedule to the Constitution and the Public Gambling Act, 1867.

2.4.5 Therefore, the Court, in no uncertain terms held that the GST Act vide the said Entry 6 of Schedule III cannot include games of skill within its ambit.

2.4.6 Therefore, in light of the High Court order, it has now become abundantly clear that the distinction between games of skill and games of chance should be made for the determination of exigibility of any online game to GST.

2.5 Therefore, in light of the High Court order, it has now become abundantly clear that the distinction between games of skill and games of chance should be made for the determination of exigibility of any online game to GST.

Distinction between games of skill and games of chance is internationally prevalent

2.6 This view is also in line with international jurisprudence on the matter which holds that the distinction between games of skill and games of chance is crucial to determine the legality and taxability of games.

2.6.1 In the Canadian case of Rex v. Fortier18, the distinction between games of chance and games of skill was set out by the Court stating that, “[A] game of chance and a game of skill are distinguished on the characteristics of the dominating element that ultimately determines the result of the game.”

2.6.2 In the case of State v. Gupton19, the Supreme Court of North Carolina held that any athletic game or sport is not a game of chance. In the United States, the ‘dominant factor test’ is applied by many States to determine whether or not a particular game is a ‘game of skill’ or ‘game of chance’. For instance, poker is considered to be a game of skill because more skilful players will always win over the less skilled or novice players.

Recommendations 3 and 4

Rate of GST at 28% on the full value of turnover

The GoM has recommended that “GST may be levied at the rate of 28% on all activities namely Casinos, Race Courses and Online Gaming” and “In case of online gaming, the activities be taxed at 28% on the full value of the consideration, by whatever name such consideration may be called including contest entry fee, paid by the player for participation in such games without making a distinction such as games of skill or chance etc.”

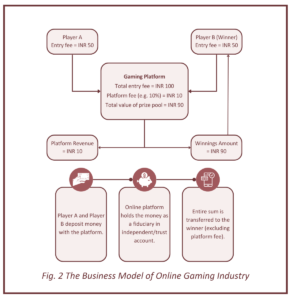

3.1 It is necessary to understand the business model of online gaming so as to better appreciate the consequences of taxing it at 28% on the full turnover value. Figure 2 indicates the typical business model of the industry. The players pay the entry fee which consists of two components– the prize pool money and the platform fee charged by the gaming platform provider.

Recommended rate of 28% might lead to lesser channelization

3.2 The optimum tax rate and value is internationally decided based on two factors – (a) channelization and (b) tax revenues. Channelization refers to the proportion of online gaming activities that are operated within the licensing system and do not resort to the grey market.

3.3 Research on taxation practice20 internationally suggests that –

- Tax-rates of 15-20% can achieve both high channelization as well as high tax-revenues,

- Tax-rates above 20 percent are likely to lead both to lower channelization and tax-revenues, as operators within the system become less competitive and consumers choose operators outside the system instead,

- Tax-rates below 15 percent may lead to incremental increases in an already high level of channelization, but at the expense of substantially lower tax-revenues.

3.4 Therefore, the rate of 28% on total consideration recommended by the GoM, if imposed, might encourage the movement of the gaming industry into the grey market or into other favourable taxing jurisdictions. Such an unfortunate move might lead to loss of substantial foreign investment moving into the Indian economy and harm the Digital India image that the country has built over the last few years. Contrasts both the GGR model and the Turnover Tax model

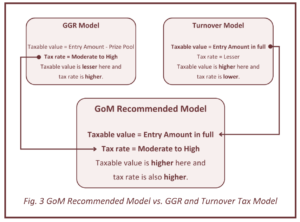

3.5 Further, an appreciation of the international practice on taxing online games is illustrative in this context. There are two models internationally on taxing online games. One, the Gross Gaming Revenue (GGR) Tax model with moderate tax rate. Two, Deposit or Turnover Tax model with lower tax rates.

3.5.1 In the GGR model, the platform or the game operator is taxed on the entry amount minus the amount ascertained towards the prize pool. In essence, tax is payable in the hands of the operator only on the value that pertains to the service offered by the platform and treated as the platform fee. The tax rate in this model is moderate to high. Countries where such a model is adopted are listed in Annexure – 1. A closer perusal indicates that the highest tax rate in this model is also less than 25%.

3.5.2 In the Turnover Tax model, tax is levied on the entire entry amount and there is no deduction of the prize pool. In essence, the entry amount is the taxable value, and the tax rates are kept much lower since the taxable value is large. Countries where such a model is adopted are listed in Annexure – 2. The highest tax rate in this model is 5.3% imposed by Germany.

3.5.3 Globally, in recent years, countries are moving away from the Turnover Tax model to GGR model to increase tax revenues, discourage the grey market, and to ensure ease of compliance.

3.5.4 The example of United Kingdom is instructive. The UK shifted its tax structure from the Turnover Tax model to the GGR model for the online gaming industry. Earlier under the Turnover Tax model, the UK was levying 6.75% on the pooled money. However, with the shift to the GGR model, the tax rate was changed to 15% of the revenue less the winning prize. The rationale of the UK Government for this shift was to reduce the movement of bookmakers to offshore locations with better tax models, thereby leading to revenue loss to the UK exchequer. Even the senate of France has approved the regime change in terms of taxing gaming activities from turnover to GGR model. France taxed based on turnover value at 20% – the highest in the world. However, there was no income tax on gambling gains in France. Now, France is transitioning to a taxation system based on GGR and different rates for different activities like casino, gambling, gaming etc.21

3.6 The recommendations of the GoM are neither in line with the GGR model nor with Turnover Tax model but takes the non-complementary aspects of both these models and merges them together as illustrated in Figure – 3.

3.7 This approach of choosing both the higher taxable value and the higher rate of tax is prejudicial to the interests of an emerging high growth potential industry. The vision is to make India a global gaming innovation hub.22 But the recommendation of the GoM is in contradiction to such vision and can sound a death knell to the sunrise industry in the country.

Contrasts current jurisprudence on taxability and rate of tax of games of skill

3.8 The GoM recommends including prize pool money in taxable value. However, the prize pool money is typically held in an independent trust account. This prize pool amounts to an actionable claim falling within the scope of the Entry 6 of the Schedule III under Section 7(2) of CGST Act i.e., this activity or transaction pertaining to such actionable claim can neither be considered as supply of goods nor supply of services whenever the online game does not amount to gambling and betting or wagering but is a game of skill. This position has been clearly articulated by the Hon’ble High Court of Karnataka in the case of Gameskraft Technologies Private Limited.23

3.9 The Hon’ble High Court has further clarified that the prize pool money does not form part of the consideration for playing the game and hence does not form part of the taxable value. It explained this position as follows –

“It is also erroneously contended that even this amount shall be included in the definition of expression ‘consideration’ as per Section 2(31) of the Act, which reads as under-

(31) “consideration” in relation to the supply of goods or services or both includes – (a) any payment made or to be made, whether in money or otherwise, in respect of, in response to, or for the inducement of, the supply of goods or services or both, whether by the recipient or by any other person but shall not include any subsidy given by the Central Government or a State Government. (b) the monetary value of any act or forbearance, in respect of, in response to, or for the inducement of, the supply of goods or services or both, whether by the recipient or by any other person but shall not include any subsidy given by the Central Government or a State Government;

Provided that a deposit given in respect of the supply of goods or services or both shall not be considered as payment made for such supply unless the supplier applies such deposit as consideration for the said supply;

The scope of the definition of ‘consideration’ extends only in relation to “the supply of goods or services or both”. However, the said activity or transaction relating to the actionable claim qua the amounts of participants pooled in independent trust arrangement, for which only acknowledgement is given, is neither supply of goods nor supply of services. Therefore, the same is clearly out of the purview of the expression ‘consideration’. Since the CGST Act itself does not allow the imposition of Tax on such ‘actionable claim’ in relation to the Online Fantasy Sports Gaming of the respondent No.3, it being other than lottery, betting and gambling, the said Rule 31A (3) of CGST Rules 2018 cannot be read in such a manner so as to override the parent CGST Act. The said Rule 31A (3) reads as under:-

“31A. Value of supply in case of lottery, betting, gambling and horse racing. – (3) the value of supply of actionable claim in the form of chance to win in betting, gambling or horse racing in a race club shall be 100% of the face value of the bet or the amount paid into the totalisator.”

Since the actionable claim in the Online Fantasy Sport Gaming of the respondent No.3 are amongst such actionable claims as per Schedule III and Section 7(2) of the Act, which are not considered as ‘supply of goods’ or ‘supply of services’, Rule 31A has no application. Moreover, actionable claims referred to in Rule 31A are limited to only activities or transactions in the form of chance to win in “lottery” or “betting” or “gambling” or “horse racing in a race club”. Thus, Rule 31A which is restricted only to such four supplies of actionable claim, has no application in this case.”

Reliance on the Skill Lotto order of SC fails to appreciate the nuance of the order

3.10 The GoM report bases its logic on the fact that the Hon’ble Supreme Court has in the case of Skill Lotto24 upheld the valuation on face value of lottery in accordance with section 15(1) read with section 15(5) of the CGST Act, 2017 and Rule 31(A) of the CGST Rules, 2017.

3.11 Such reliance is grossly misplaced since the activity of lottery has clearly been distinguished from games of skill by the Hon’ble SC on multiple occasions including in the case of Skill Lotto. Lottery and gambling are res extra commercium and are consequently not protected under Article 19(1)(g) of the Constitution of India. However, games of skill are constitutionally protected legitimate trade activities.

3.12 Further in the case of Skill Lotto, the question for consideration was entirely restricted to lottery. The question as framed by the SC makes this abundantly clear. It asked – “whether while determining the face value of the lottery tickets for levy of GST, prize money is to be excluded for purposes of levy of GST?” To stretch this and make it applicable for games of skill which have repeatedly been held to be legally and constitutionally protected business activities is absurd at best.

3.13 The reliance on the Skill Lotto order to recommend for the applicability of section 15(1) read with section 15(5) of the CGST Act, 2017 and Rule 31(A) of the CGST Rules, 2017 to arrive at the taxable value for all online games without appreciating that games of skill are a genuine business activity recognized and encouraged by the Government of India unlike lottery, gambling and betting which are res extra commercium, is unfortunate and in gross violation of the long standing judicial reasoning on the matter.

Previous policy recommendations by fitment committee was on GGR as against full value

3.14 The Fitment Committee of the GST Council had recommended that “the value of supply may be fixed as Gross Gaming Revenue (GGR) which is internationally prevalent. Tax rate to be suitably decided or the rate applicable be clarified.”25

Effective taxation (GST + Income Tax) would be exceedingly high

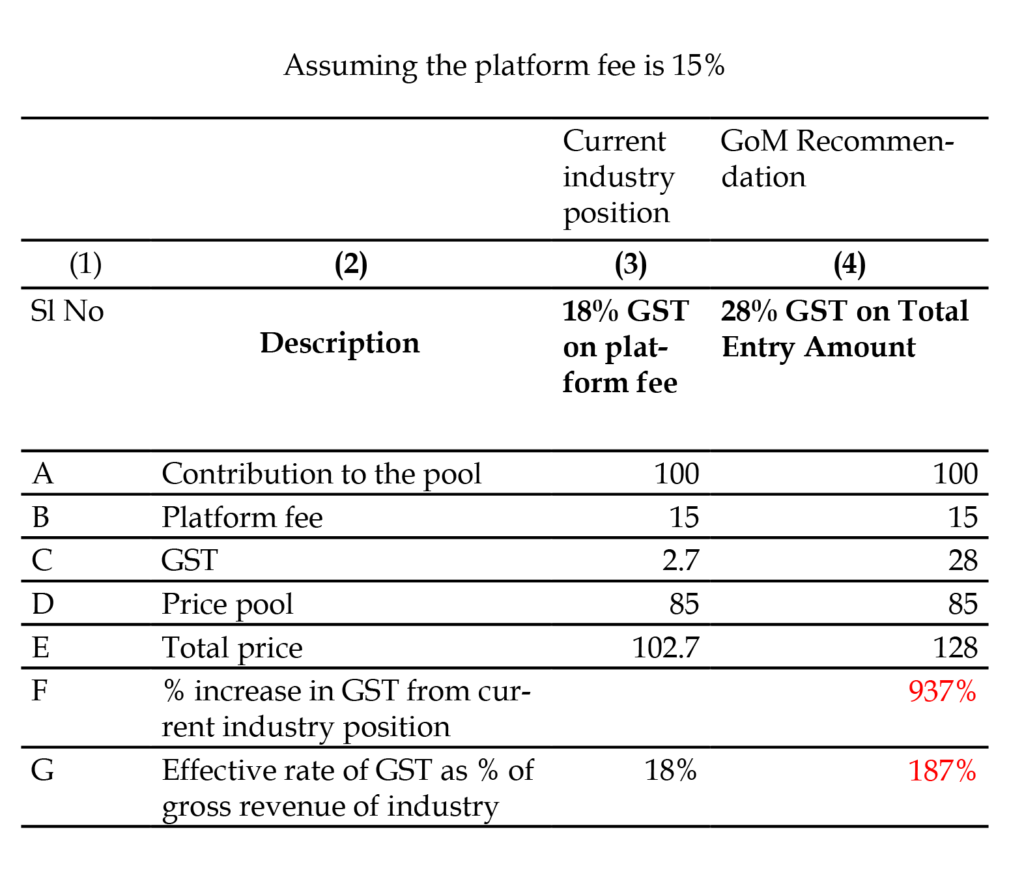

3.15 The Hon’ble FM in Budget 2023 introduced inter alia sections 115BBJ and 194BA in the Income Tax Act, 1961. Consequently, the net winnings from online games shall be subjected to income tax at 30%.26 Now that the winnings are separately taxed at 30%, to tax the entire entry amount at 28% would result in an exceedingly high rate of tax.

3.16 Such a position would tantamount to turning the industry not profitable since the effective rate of GST as percentage of gross revenue of industry would be in excess of 100% as illustrated in Table – 1. This would decimate the industry in one go and wipe away the vision of the Hon’ble PM of making India a global gaming hub.

Table 1. Illustrating effective tax in current position vs. GoM recommended position

C. Conclusion

C.1 Therefore, as discussed above, the recommendations of the GoM fail to adequately appreciate the legal nuances at stake in the matter. Based on the points brought out hereinbefore, we recommend the following –

- Online games of skill should not be bracketed with activities like gambling, betting, lottery and deserve to be considered separately in their own right.

- Differentiate games of skill from activities like betting, gambling and lottery which have clearly been held as res extra commercium. This lack of differentiation has led to an unfortunate clubbing of a legally recognised and constitutionally protected activity – games of skill – with activities like lottery, betting and gambling.

- Revisit the valuation and tax rate of the online games so as to bring them in line with the increasing global standard based on the Gross Gaming Revenue (GGR) model.

C.2 The appointment of the Ministry of Electronics and Information Technology (MeitY) as the central nodal agency to regulate online gaming has been an important development. The Amendments brought out by MeitY to the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules 2021 (“IT Rules 2021”) provide for every game to be certified by a Self-Regulatory Body to be recognised by the Central Government. These rules reinforce online gaming as a legitimate business activity, effectively differentiating it from betting and gambling. They also show the trust the Government is placing in the industry by allowing for self-regulation.

C.3 Therefore, any game that will be certified by the Self-Regulatory Body, to be recognised by the Government of India, will enjoy a clear and distinct legal status from gambling, betting and lottery. It is important that the GoM appreciate the role and responsibility of the Self-Regulatory Body and accordingly allow for the judgement of such Self-Regulating Body to prevail on the determination of the status of the game in question.

C.4 While the MeitY rules make it abundantly clear that the Government of India intends to encourage and create an innovation-friendly ecosystem for online games, the recommendations of the GoM are in a diametrically opposite direction. It is essential that the recommendations of the GoM be revisited so as to achieve a taxation system which is in consonance with the larger policy of the government to create a business-friendly environment for this high potential industry. Such a harmony in the thought of policy makers across the different ministries of the Government will go a long way in ensuring that the policy environment is conducive for mature innovations to happen in the Indian economy.

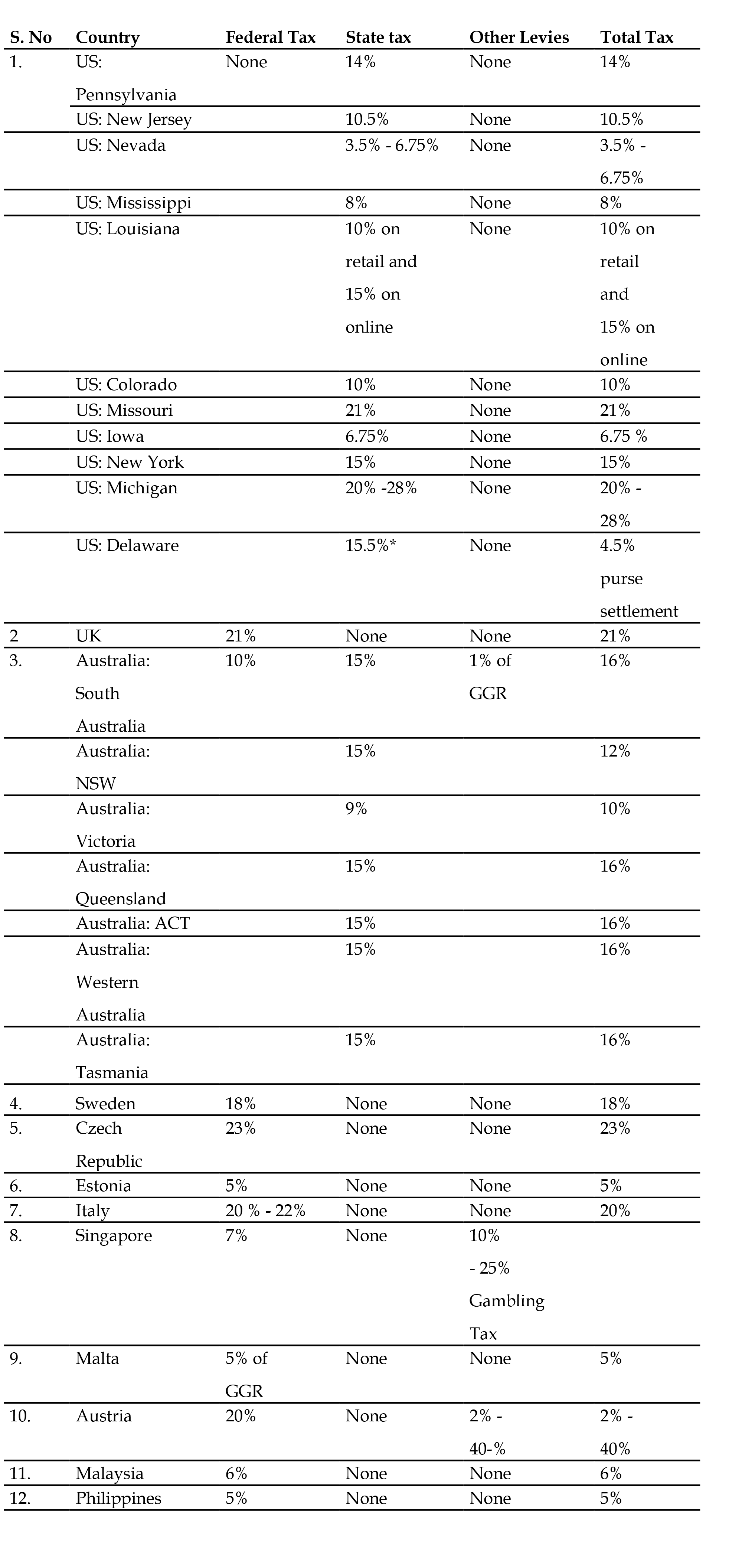

Annexure 1

Source: Taxation of the Digital Economy: International best practices in GST for online gaming. Lakshmi Kumaran

and Sreedharan, 2022.

Note: In Australia, where both Federal and State tax are imposed, a rebate in the form of

Digital Games Tax Offset (DGTO) is offered to promote the growth of Australia’s digital games

development industry. 27

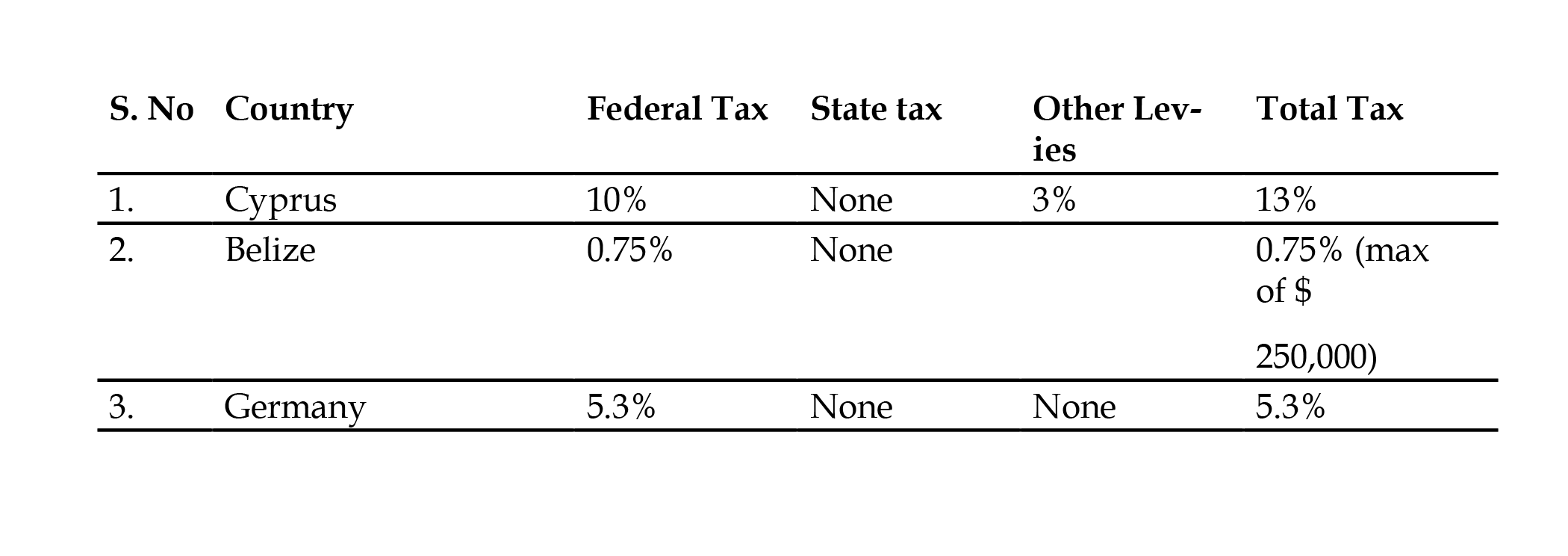

Annexure 2

Source: Taxation of the Digital Economy: International best practices in GST for online gaming. Lakshmi Kumaran

and Sreedharan, 2022

End Notes

1. Gaming sector has huge International Market, India trying to increase its footprint in it: Modi, The Indian Express, March 3, 2022, https://indianexpress.com/article/cities/delhi/gaming-sector-huge-intl-market-india-trying-increasefootprint-modi-7797747/

2. Budget Speech during presentation of the Union Budget 2023-24, https://www.indiabudget.gov.in/doc/Budget_ Speech.pdf

3. Explained: How Rapidly Is The Gaming Industry Growing In India, https://www-indiatimes-com/explainers/news/ how-rapidly-is-the-gaming-industry-growing-in-india-589059.html

4. Guiding principles for the Uniform National level regulation of online fantasy sports platforms in India, Niti Aayog, December 2020, https://niti.gov.in/sites/default/files/2020-12/FantasySports_DraftForComments.pdf

5. Gaming, https://www.investindia.gov.in/sector/media/gaming

6. Unicorn Tracker – India, https://www-ventureintelligence-com/Indian-Unicorn-Tracker.php

7. State of Bombay v. RMD Chamarbaugwala – AIR 1957 SC 699

8. RMD Chamarbaugwalla v. Union of India – AIR 1957 SC 628

9. State of Andhra Pradesh v. K. Satyanarayana & Ors – AIR 1968 SC 825

10. M.J. Sivani v. State of Karnataka, (1995)6 SCC 289

11. Dr. K. R. Lakshmanan v. State of Tamil Nadu – (1996)2 SCC 226

12. M/s. Junglee Games India Pvt. Ltd. v. State of Tamil Nadu [W.P. 18022 of 2020]

13. All India Gaming Federation v. State of Karnataka [WP No. 18703/2021]

14. Gameskraft Technologies Private Limited Vs Directorate General of Goods Services Tax Intelligence, Writ Petition No. 19570 of 2022

15. Report No. 276 – LEGAL FRAMEWORK: GAMBLING AND SPORTS BETTING INCLUDING IN CRICKET IN INDIA, Law Commission of India, July 2018

16. Gameskraft Technologies Private Limited Vs Directorate General of Goods Services Tax Intelligence, Writ Petition No. 19570 of 202

17. Diwan Brothers v. Central Bank of India – AIR 1976 SC 1503

18. 13 Q.B. 308.

19. 30 N.C. 271

20. Copenhagen Economics: Report on licensing system for online gambling, 2016. https://copenhageneconomics.com/ wp-content/uploads/2021/12/copenhagen-economics-2016-licensing-system-for-online-gambling.pdf

21. https://igamingbusiness.com/casino-games/french-senate-approves-shift-to-ggr-tax-for-gambling/; Taxation of the Digital Economy: International best practices in GST for online gaming. Lakshmi Kumaran and Sreedharan, 2022

23. Gameskraft Technologies Private Limited Vs Directorate General of Goods Services Tax Intelligence, Writ Petition No. 19570 of 2022

24. kill Lotto Solutions Pvt Ltd. vs Union of India, WP (Civil) No.961 OF 2018, 2020 SCC OnLine SC 990

25. Agenda for 37th GST Council Meeting Volume – 3, Annexure V, SI. No. 4, https://gstcouncil.gov.in/sites/default/files/ Agenda/37-meeting/Detailed%20Agenda%20Note%20-%2037th%20GSTCM%20-%20Volume%203.pdf

26. Finance Bill 2023, https://incometaxindia.gov.in/news/finance-bill-2023-highlights.pdf

27. Digital Games Tax Offset, Treasury of the Government of Australia, https://treasury.gov.au/consultation/c2022- 255934

A PDF version of the report is available here.

©Creative Commons Licence, 2023

Designed by: Shriya Bhatia, Lead Graphic Designer, DeepStrat