Indicators for Detection of Abusive Digital Lenders

Context

Digital lending is growing rapidly and along with the growth there has been a noticeable rise in consumer harms. These harms arise due to a variety of factors such as regulatory void on upcoming technology and data use in the financial sector, digital literacy, financial literacy leading to exploitative practices and suboptimal outcomes such as eroding consumer trust. Identification of abusive practices to overcome the harms hence becomes a key issue towards a common good for everyone in the ecosystem. This brief aims at documenting a list of indicators to spot abusive digital lenders from publicly available metadata around digital loan apps.

Data Sources Available

Google Play – Source metadata about apps by country, metadata about each app, their permissions, reviews, etc.

List of 3rd party providers offering services to digital lenders.

Methodology

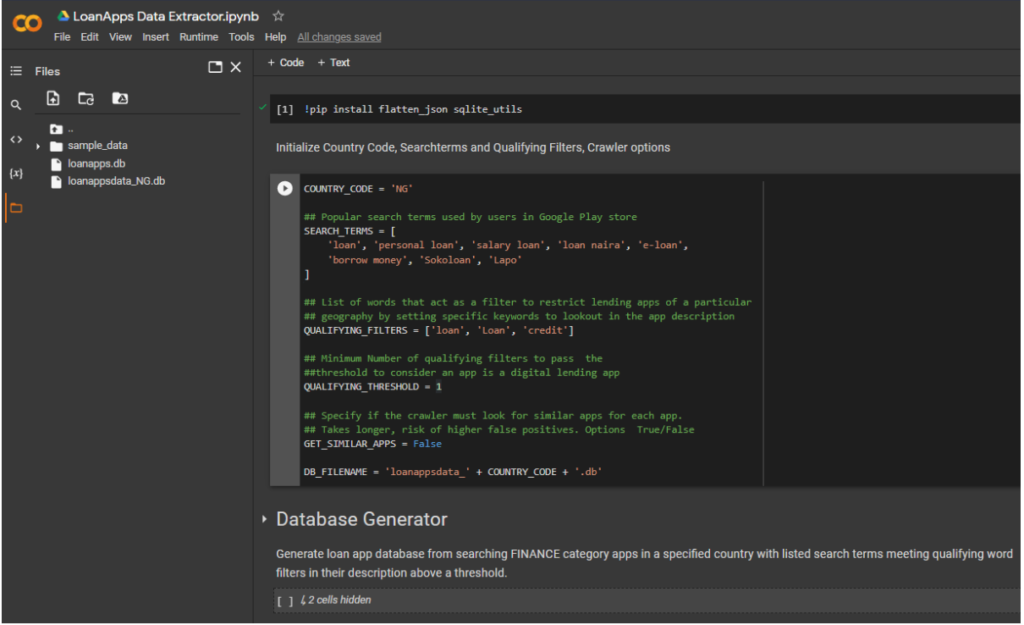

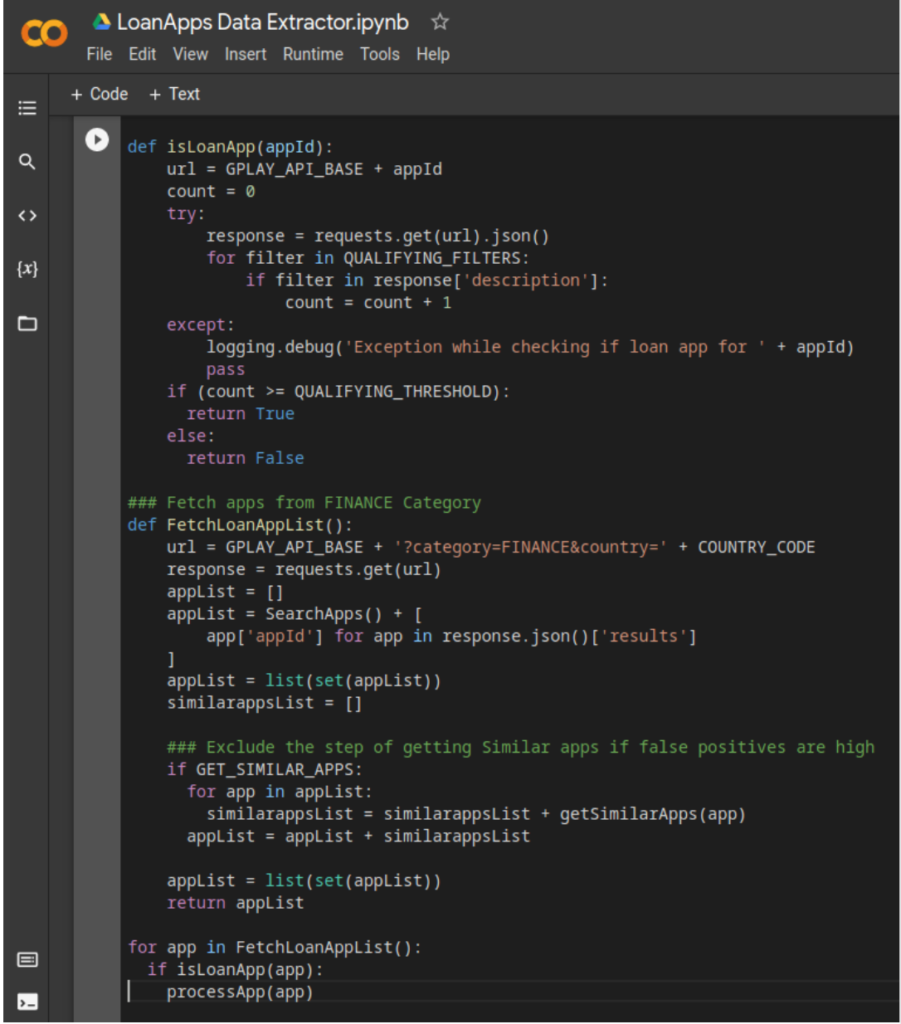

1. Fetch list of loan apps from Google Play FINANCE category in the country (e.g. Nigeria), search results in Google Play store for popular search terms and similar apps. This could also be used to run for any country and get a list of loan apps.

Screenshot of Script

2. Fetch app metadata including the permissions data for all apps from the above list.

a. Following are the various attributes available for a given app as metadata, along with some notes

| Attribute | Text | Notes |

| ID | Unique ID for the record | |

| Title | Title of the app | |

| Description | Description | |

| DescriptionHTML | Description in HTML | |

| Summary | Summary of the app | |

| installs | Installs as displayed on Google Play | Install data is gameable with bot downloads for higher listing in search, doesn’t represent actual user base as users may have installed, but never used / installed via other app stores / sideloaded. |

| minInstalls | Minimum Installs | |

| maxInstalls | Approx * Maximum Installs | |

| score | Weighted average of ratings | |

| scoreText | Rounded off score displayed to user | |

| ratings | Total number of users who rated | |

| 1 * | 1 Star | Ratings and reviews are gameable too, usually are gamed widely across apps. |

| 2 * | 2 Star | |

| 3 * | 3 Star | |

| 4 * | 4 Star | |

| 5 * | 5 Star | |

| price | For paid apps | |

| IsFree | Free/Paid filter | 0 for non-free, 1 for Free. Most apps are usually free. |

| currency | Currency for app pricing | |

| FreeText | ||

| In App Purchase | In app purchase – with GPlay payment support options | 0 for no IAP, 1 for IAP Supported. Most apps don’t use IAP |

| Size | App Size | |

| androidVersion | Minimum Android API level | |

| androidVersionText | Textual android version support note | |

| Developer | Name of Developer | |

| Developer ID | Developer ID | |

| Developer Email | Developer Email | |

| developerWebsite | Developer Website | |

| developerInternalID | Internal ID of developer in Google Play |

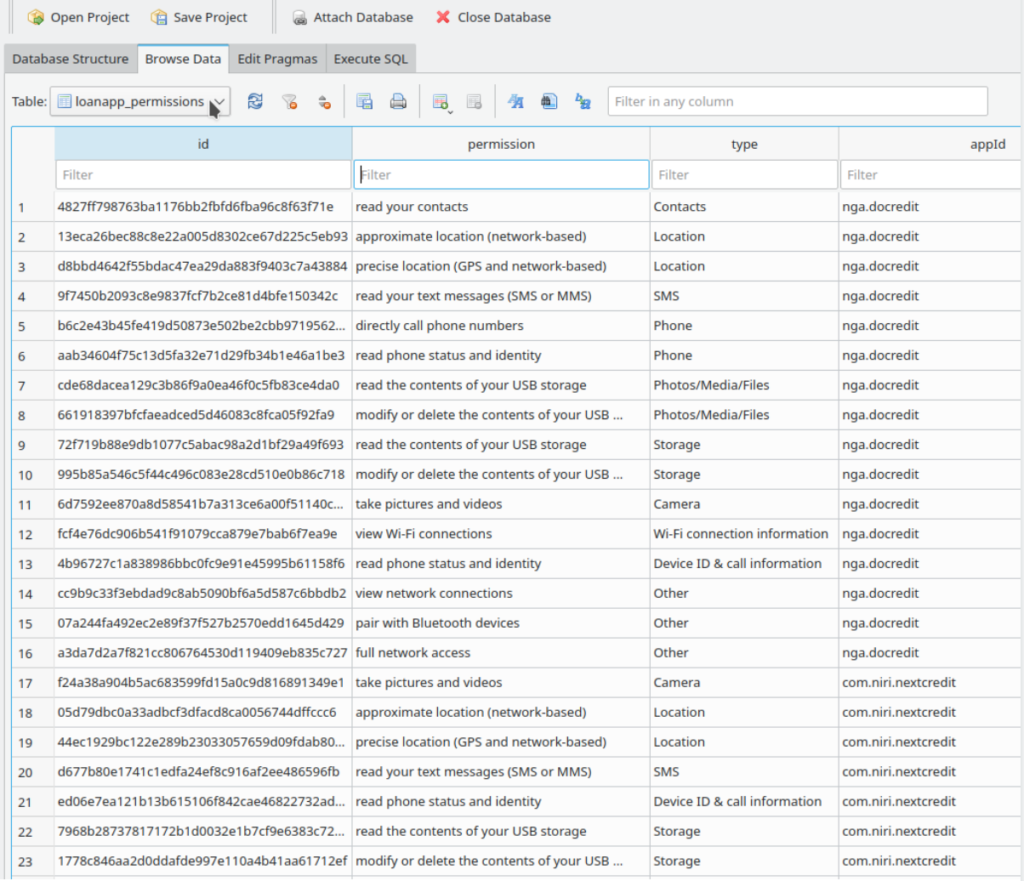

Screenshot of permissions table of the database

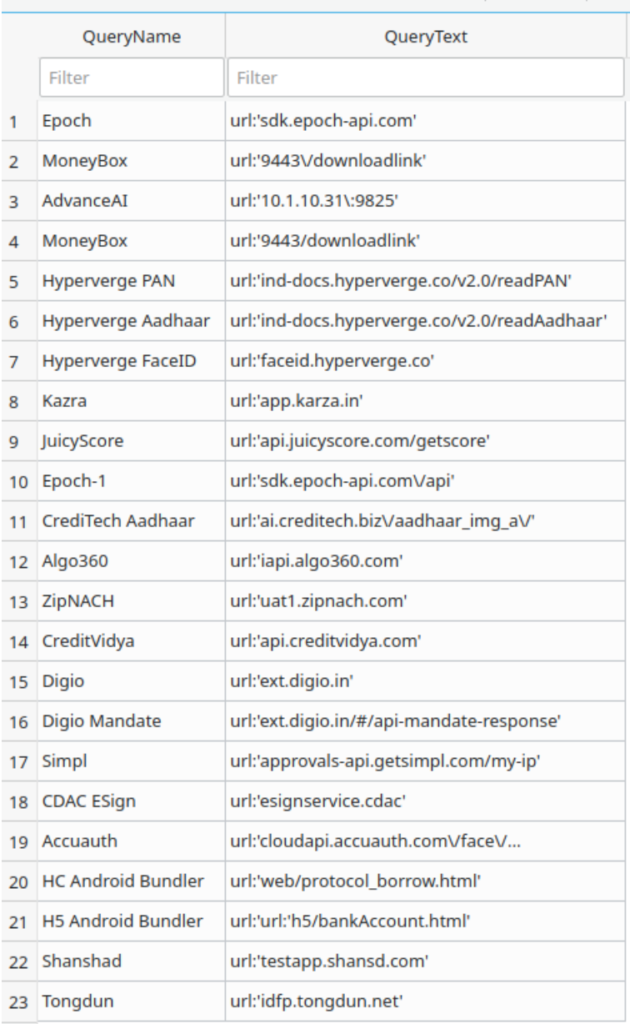

3. Additionally perform malware analysis on the app to list the communicating servers to build a 3rd party provider database of loan apps.

a. Single app takes 15-20 minutes to manually go through the data (scope for automating this process but this would then still need to be analysed).

b. Indicative list of third parties in India, identified after malware analysis of loan apps. Constant monitoring of apps to identify vendor supply chain is key to mapping the support ecosystem and spot bad actors early on.

4. Analyse the above data for indicators to spot potentially harmful lenders.

Overview of Indicators

- Brand, Advertising – Trademark violation, phishing. Automatable, with some manual review

- From a consumer standpoint, the first interaction with a lender is through advertising and brand awareness at the app store / mobile ad / offline ad about the lending app. While disproportionate spend on marketing is a flag for the consumer, a trustable brand differentiates itself by providing the commitment to customer, while most apps that try to gain trust by piggybacking themselves with other established brands by similar sounding names, trademarks are an early red flag indicator.

- E.g:- CashTM (PayTM font, colour scheme, maybe trademark highjack)

- Excessive App Store Optimisation (ASO) – CashBean (IN) – com.loan.cash.credit.easy.dhan.quick.udhaar.lend.game.jaldi.paisa.borrow.rupee.play.kredit

- A similar ASO strategy being practised in Nigeria by KashCredit – indicates re-use of same playbook / possibly same actors.

Actors are using the same playbook, but it may also be the same actors.

2. App Metadata

-

- Release date – Analysis of metadata from Google Play / other app stores could indicate if the app predates the legal entity which owns the app. In the real world, most apps get built after a legal entity is formed and exceptions to this rule are a high risk indicator that the app is run by anonymous / unidentified, potentially rogue actors. This could be automated by extracting and comparing the release date from Google Play and an incorporation date from a third party database.

- Developer email ID – This also indicates if the same entity owns the app / if the app is vendor managed / other partnership structures. Due diligence on entity data from these can help consumers spot rogue lenders.

- It may be possible to scrape companies data, to find out who is behind the apps, but it varies country to country. Also company registration process/scrutiny/process different across countries.

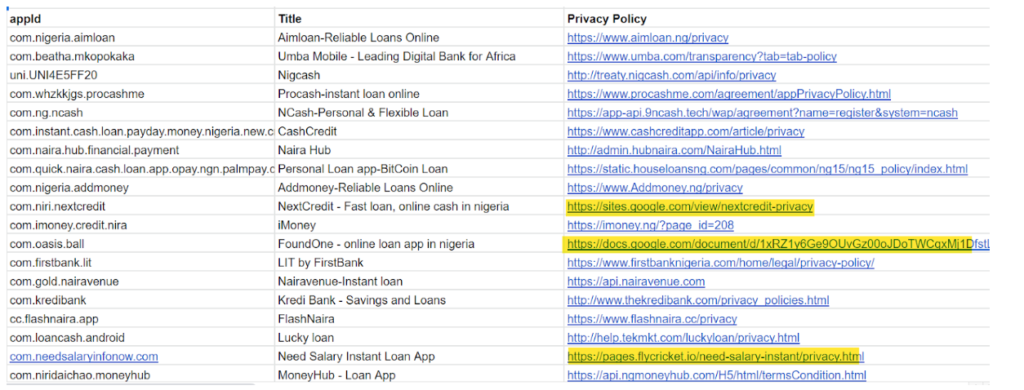

- Privacy policy – The language of privacy policy and terms and conditions can also be used as indicators. While more often than not, these are legalese boilerplate texts, the rogue lending apps, don’t host them on their domains and use Google docs / other static web hosting to host these pages.

- Non-domain hosted privacy policies e.g. gDocs, are more suspect.

- Public presence – Website of the apps, their professionalism (Sites have unlinked / missing pages) is also a good proxy indicator if a loan app is run by a trustable entity / rogue lender.

- Many sites have standard templates, and sometimes don’t change the default settings, e.g. default privacy policy.

3. Physical Presence

- Address – The address information in the app metadata can be used to identify if the entity has a physical presence in the country, supports communication with users in local language, complies with regulations, has a legally responsible point of contact for grievance handling. While some jurisdictions do allow partnership structures without need for physical presence, increasingly physical presence is being mandated for overseas apps.

4. Cyber Hygiene

- Cyber Hygiene broadly refers to the tech practices by the provider and this could indicate if consumers are protected in the digital world. Frequency of app updates can be a useful proxy indicator for product increments / iterative market feedback and a stale app (any more older than 90 days) is a red flag. This could indicate an outsourced or lack of active technical team, increasing susceptibility to platform breakdowns or cyber threats.

- Infrastructure upgrades & responsiveness to cyber incidents are also useful indicators of having made right investments into technology operations and that assures consumers of dealing with an entity that is respectful / concerned about user-data. These could be assessed using threat-intel repositories like VirusTotal.com etc

5. 3rd Parties

- 3rd parties – A digital lender might outsource one / more / all functions to a range of 3rd parties that include tech intermediaries like KYC providers, data providers, payment processors and operational intermediaries like sales / recovery operations.

- With additional time and manual investigation, areas to explore include:

- Which 3rd parties are the go-to for predatory apps?

- What is the cyber hygiene of 3rd parties?

- Add list of 3rd party providers for India. The following is a list of 3rd parties identified in loan apps in India that were in use in 2021.

- With additional time and manual investigation, areas to explore include:

| Steps |

Service |

Providers |

| Customer acquisition | Targeted ads via different channels | Google, Facebook, Youtube, Rummy sites, Ad SDKs |

| KYC and Fraud check | Checks for ID verification and facial recognition | IDfy (India), Hyperverge (US), Advance.ai (China), DeepFinch (China), Veri5Digital (India), Link Face (China) |

| Risk scoring | Capture mobile and personal data to score borrowers | Credit Vidya (Indian), Tongdun (China), Flashcloud (China), Epoch (China), Risk Cloud (China) Juicy Score (Russia), Fintopia (China), Zhenrongbao CN |

| Loan disbursal | Plug into banking APIs to disburse money into borrowers’ account | Finflux (Indian) |

| Loan management | Help manage the loan lifecycle | Finflux (Indian), Perfios (Indian) |

| Loan servicing | Integrate with SMS providers to remind about due dates | Kaleyra (US), Twilio (American), |

| Loan collection | Integrate with payment gateways to collect money from borrowers | Razorpay (Indian), Cashfree (Indian) |

| Digital Loan collection | Collection bots that make automated calls to overdue borrowers |

Flashcloud (China), |

-

- Analysis of data practices and cyber hygiene of 3rd parties is a useful indicator of the potential to cause unintended consumer harm.

- Whitelabel providers – Analysis of apps can also indicate use of whitelabel providers and tracking history of whitelabel providers can also indicate structural harms that have happened in the past and how it was handled.

6. App Features (mostly manual, with some automation)

- App permissions give a broad overview of the capabilities the lender is interested in and mapping of these across ecosystems can indicate if a lender is too pesky on data / wants more control on the borrower.

- A strict

- In Nigeria, apps used 16 permissions on average, but some lenders had up to 40 permissions. A script could be written to extract and summarise key statistics.

- Summary if possible

- Clear UX – Consent on data use is non-negotiable for a responsible lender. Additionally, clear terms of repayment should be disclosed upfront.

- Document trail – Email / SMS – multi-channel documentation delivery.

- Background activity – Apps with high background activity may be constantly pushing data from the phone to the app’s servers. This should require explicit consumer consent that is comprehensible, inclusive of data harms of such collected data.7. Responsiveness

-

- CRM – Whether apps are actively responding to customer reviews or complaints can be codified on lender responsiveness. This could be automated via review of Google Play data.

- Social media – Similarly, one could analyse checking an app’s responsiveness via social media channels. While this currently requires manual review, this could be automated via social media / sentiment analysis.

Deep dive of select indicators

-

Permission Analysis

- While most apps use a common set of permissions for various reasons ranging from KYC to credit assessment to liveness detection, there have been apps that use excessive permissions either for data grab / constant post-loan surveillance / control of the device.

- Derive insights on least used permissions, most used permissions and map it against stated / unstated use of such permissions to analyse the possibility of harm.

Example :-

- Of the 100+ apps in Nigeria identified as lending app in Nigeria, following is a list of popular permissions used by the app.

| read the contents of your USB storage | 116 |

| modify or delete the contents of your USB storage | 116 |

| read phone status and identity | 116 |

| view network connections | 116 |

| full network access | 116 |

| prevent device from sleeping | 103 |

| view Wi-Fi connections | 96 |

| take pictures and videos | 95 |

| precise location (GPS and network-based) | 86 |

| read your contacts | 85 |

| approximate location (network-based) | 84 |

| find accounts on the device | 80 |

| control vibration | 60 |

| connect and disconnect from Wi-Fi | 57 |

| read your text messages (SMS or MMS) | 53 |

| run at startup | 47 |

| read calendar events plus confidential information | 34 |

| add or modify calendar events and send email to guests without owners’ knowledge | 24 |

| pair with Bluetooth devices | 23 |

| modify your contacts | 21 |

| modify system settings | 21 |

| record audio | 17 |

| change network connectivity | 17 |

| read your own contact card | 16 |

| receive text messages (SMS) | 15 |

| draw over other apps | 15 |

| directly call phone numbers | 15 |

| control flashlight | 15 |

| access extra location provider commands | 15 |

| retrieve running apps | 12 |

| read Google service configuration | 12 |

| access USB storage filesystem | 12 |

| access Bluetooth settings | 11 |

| read battery statistics | 8 |

| read your Web bookmarks and history | 7 |

| reorder running apps | 6 |

| read sensitive log data | 6 |

| read call log | 5 |

| control Near Field Communication | 5 |

| change your audio settings | 5 |

| set an alarm | 4 |

| send sticky broadcast | 4 |

| create accounts and set passwords | 4 |

| allow Wi-Fi Multicast reception | 4 |

| use accounts on the device | 3 |

| read sync settings | 3 |

| measure app storage space | 2 |

| change system display settings | 2 |

| add or remove accounts | 2 |

| Google Play license check | 2 |

| toggle sync on and off | 1 |

| read terms you added to the dictionary | 1 |

| make/receive SIP calls | 1 |

| disable your screen lock | 1 |

| close other apps | 1 |

| add words to user-defined dictionary | 1 |

- read your Web bookmarks and history for instance is an excessive permission, but is being used by at least 7 apps. But this was cited in an IMF paper as a novel way in using new types of information for credit assessment.

- add or modify calendar events and send email to guests without owners’ knowledge – Apps doing *anything* without the knowledge of the owner of the device, especially modifying calendar events is cause for concern. Specific usage of this permission needs to be studied in the local context.

.

2. 3rd Party Provider analysis.

- A digital lending app integrates multiple 3rd parties which a lender might prefer to outsource the operations. It is also possible, for whitelabel provider – who manages a service offering such as “Lending App as a service” to any investor wanting to be present in the market.

- The behaviour and customer experience of a lending app is also a function of customer experience of these individual outsourced components that is part of the offering.

- The analysis of third party providers can give useful indicators on size of market outside of Google Play, number of apps and operators who have numerous apps based on the same template of 3rd party providers.

- Analysing data flows can also determine the data-power differentials in the ecosystem and if 3rd parties can become powerful rent-seeking intermediaries and in some cases, actually be in the digital lending industry by publicly posing as 3rd parties to avoid liabilities.

- Advance.AI is a global facial recognition based KYC provider operating in multiple markets and has been building a private facial recognition based credit score product. Given the governance void around facial recognition and data protection in many of the markets they operate, a powerful data intermediary poses risk not just to consumers, but also to competition.

- Geo-politically, a large number of 3rd parties in the space operate out taxation-lite / neutral locations such as Singapore / Hongkong, but have strong ties / base in China. Use of 3rd parties will increasingly be subject to geo-political scrutiny in a data-localisation based regime preferred by certain governments as geo-political strategy.

- The re-use of standard tech-stack across multiple geographies also pose the risk of dumping as tech that is outlawed / out-regulated in certain geographies will be dumped in markets without similar protection. Prevalence of such dumpware poses clear threats to consumers as they use tech that has clear issues that have been witnessed elsewhere is still put in use.

- Example – Tongdun is a Chinese fintech company that operated in China, moved to Indonesia when faced with challenges in Chinese regulation and have since moved to India, again when faced with regulatory challenges in predatory practices. The re-use of the tech infra is clearly spottable from Indian loan apps that communicate to https://idfp.tongdun.net/ – a risk scoring instance setup for Indonesia originally.

3. App Metadata Analysis.

The app metadata obtained from playstore could be subject to analysis to derive various insights. Some examples are included below of useful inferences where data could show light and lead investigators to spot potentially harmful apps.

- A view of privacy policy URLs and developer Website URLs can be useful indicators. Privacy policy pages hosted on Google docs / sites / other static web hosting services imply the digital lender doesn’t have a website of their own, is most likely an informal player, by extension could be outside formal regulatory supervision / industry self regulation. The privacy policy URLs could also reveal if the lender is using a white label, their origin. https://apph5.ncreditapp.com/yinsizhengce.html indicates a Chinese whitelabel provider behind the app.

- Age of the app, number of versions can indicate if the app gets sufficient updates necessary to keep it in sync with customer / market needs, technically safe and sound. Any app that has not received an update in the last 3 months indicates the entity behind is vulnerable to cyber risks.

3rd Party Digital infrastructures for lending

There are third parties who provide provider-level infrastructure, and ecosystem-level infrastructure. Besides market led software stack for various components of digital lending like KYC, alternate data, payments, increasingly a number of bank-led / ecosystem-led digital infrastructures are being built to enable digital credit, actively furthered by regulators / government. These technology infrastructures are designed to further machine-first, data-driven lending for various use cases, often originally aimed at addressing data-access / level playing field in the market for non-banks in the lending landscape.

While new technological infrastructure holds high potential for expanding financial access and improving lending decisions, they also pose potential harms which must be considered and addressed at their outset. Besides the generic harms arising out of algorithmic lending / fairness in AI/ML systems and data-driven credit decisioning, use of these infrastructures also enable adding a whole range of data-intermediaries into the lending value chain and brings its own risk.

S.No Infrastructure Function Opportunity Risk / Consumer harm 1. Account Aggregator (AA) Consented financial data sharing Access to trustable, systemic financial data. Heightened access to systemic banking information, leading to higher demand for data / over-consenting for credit access. 2. Open Credit Enablement Network (OCEN) Orchestrated lending via Loan Service Providers Furthers embedded lending. Newer forms of data being tapped for credit access and a large number of intermediaries. 3 * Public Credit Registry Credit Registry of all debt Attempts to solve for fixing thin-file credit history regulatorily, at population scale. Lack of clear individual insolvency regime / clean-start norms leading to exclusion. LoanApps Database Generator

The process of building the database of loan apps, getting a dump of metadata could be automated using Google Play API and data analysis on the metadata could be used to generate insights such as those mentioned above.

In addition, the list of apps could also be subjected to semi-automated malware analysis and additional metadata related to 3rd parties could be generated and subjected to analysis, deriving insights.